Post Office fixed deposits continue to be a preferred investment option for risk-averse investors due to government backing and fixed returns. To help investors plan better, the Post Office FD Calculator 2025 allows individuals to estimate their exact maturity amount within seconds, based on deposit amount, tenure, and applicable interest rate.

What Is the Post Office FD Calculator

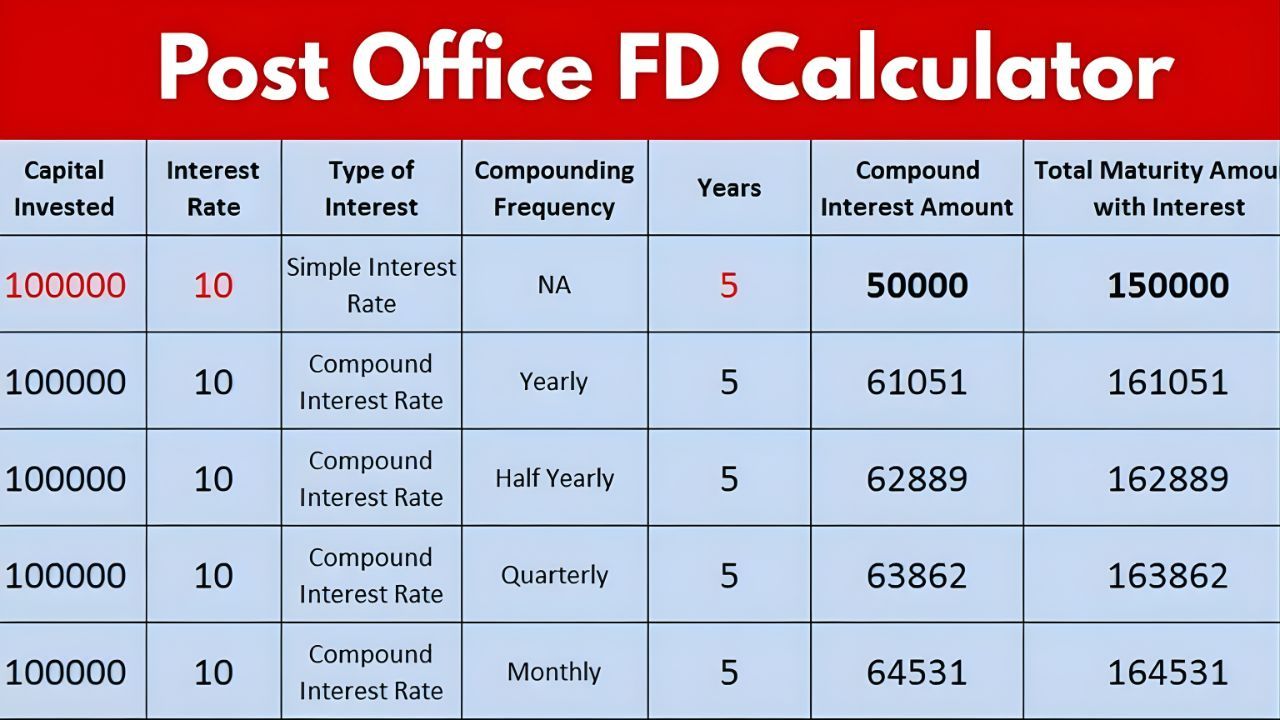

The Post Office FD Calculator is a simple calculation tool designed to show how much an investor’s money will grow by the end of the fixed deposit tenure. By factoring in the current interest rates and the selected duration, the calculator provides a clear picture of total interest earned and final maturity value.

Why the FD Calculator Is Useful in 2025

With changing interest rates and multiple tenure options, investors often find it difficult to manually calculate returns. The FD calculator removes guesswork and ensures transparency. In 2025, when many investors are prioritising safe and predictable investments, this tool helps in making informed financial decisions quickly.

How the Maturity Amount Is Calculated

The maturity amount is calculated using the fixed interest rate applicable to the chosen FD tenure. The calculation considers whether interest is paid annually or compounded, depending on the scheme structure. Once the principal amount and tenure are selected, the calculator instantly displays the interest earned and total amount payable at maturity.

Tenure Options Available Under Post Office FD

Post Office fixed deposits are available for multiple tenures, typically ranging from one year to five years. Each tenure carries a different interest rate, which directly affects the maturity value. The calculator helps compare returns across tenures, making it easier to choose the most suitable option.

Who Should Use the Post Office FD Calculator

The calculator is useful for salaried individuals, senior citizens, retirees, and conservative investors who want assured returns. It is especially beneficial for those planning long-term savings goals such as retirement, education, or capital preservation.

Accuracy and Reliability of the Calculator

The Post Office FD Calculator 2025 uses officially applicable interest rates, ensuring accurate results. While the final amount may vary slightly based on operational factors, the calculator provides a close and reliable estimate for financial planning purposes.

Benefits of Calculating FD Returns in Advance

Knowing the maturity amount in advance helps investors plan expenses, reinvestments, and savings goals more effectively. It also allows easy comparison between Post Office FDs and other fixed-income instruments like bank FDs, helping investors choose the safest and most rewarding option.

Things to Keep in Mind While Using the Calculator

The calculator assumes that the deposit remains invested for the full tenure. Premature withdrawal, if allowed, may reduce interest earnings. Investors should also remember that interest income may be taxable depending on individual tax status.

Final Takeaway for Investors

The Post Office FD Calculator 2025 is a powerful planning tool that helps investors know their exact maturity amount in seconds. With simplicity, accuracy, and government-backed security, it makes Post Office fixed deposits even more transparent and investor-friendly, supporting smarter and stress-free financial planning.