Many investors believe that wealth creation requires large amounts of money, but the reality is very different. A disciplined monthly investment of just ₹2,000 through a Systematic Investment Plan can grow into approximately ₹7.6 lakh over time, thanks to the power of compounding.

What Makes SIP a Powerful Investment Tool

A SIP allows investors to invest a fixed amount regularly, usually every month, into mutual funds. Instead of investing a lump sum, SIPs promote consistency and financial discipline. Over the long term, this regular investing helps average market fluctuations and builds wealth steadily.

Understanding the Role of Compounding

Compounding is the process where returns generated on an investment start earning returns themselves. In simple terms, your money begins to work for you. As time passes, the growth accelerates because both the original investment and the accumulated returns generate further gains.

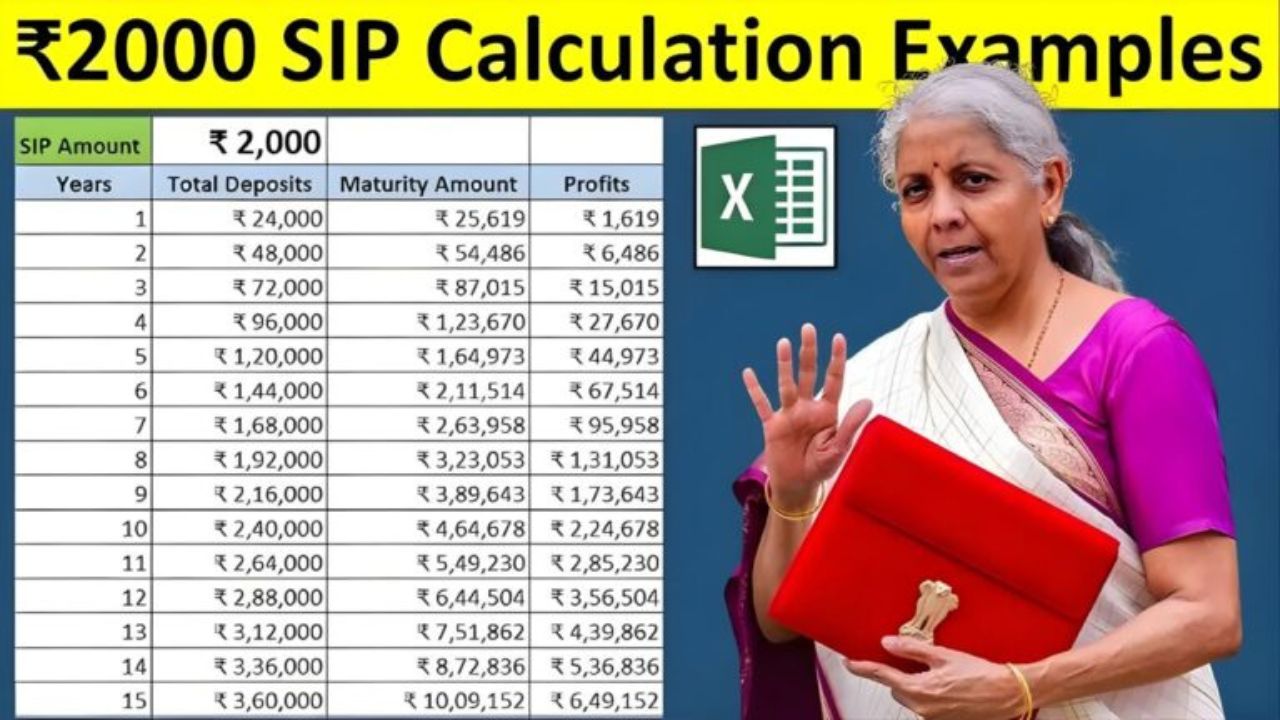

How ₹2,000 Grows Into ₹7.6 Lakh

If an investor puts ₹2,000 every month into an equity mutual fund SIP and continues this investment for a long period, the total invested amount may look modest. However, assuming a reasonable long-term annual return, the compounded growth over the years can push the final value close to ₹7.6 lakh. The longer the investment stays invested, the stronger the compounding effect becomes.

Time Is the Biggest Advantage

Compounding rewards patience. In the initial years, growth may seem slow, but as time progresses, the investment curve rises sharply. Most of the wealth creation happens in the later years, which is why staying invested is more important than trying to time the market.

Why Starting Early Matters

Starting a SIP early gives compounding more time to work. Even small monthly amounts can turn into a sizable corpus if the investment horizon is long enough. Delaying investments, even by a few years, can significantly reduce the final amount accumulated.

SIP Helps Manage Market Ups and Downs

Markets move up and down, but SIP investors benefit from this volatility. When markets are low, more units are purchased, and when markets rise, existing units gain value. Over time, this strategy smoothens investment costs and supports long-term growth.

Who Should Consider a ₹2,000 SIP

This investment approach is ideal for young professionals, first-time investors, and anyone who wants to start investing without financial pressure. Even individuals with limited disposable income can begin their wealth creation journey through a small SIP amount.

Long-Term Discipline Is the Key

The success of a SIP does not depend on short-term market performance but on consistency and patience. Stopping or frequently changing investments can weaken the compounding effect. Staying invested through market cycles is what ultimately delivers strong results.

Final Takeaway for Investors

A ₹2,000 monthly SIP turning into ₹7.6 lakh clearly demonstrates the power of compounding. Small, regular investments combined with time and discipline can create significant wealth. For investors willing to stay committed for the long term, SIPs remain one of the simplest and most effective paths to financial growth.